Top 10 European Markets for Reykjavik not yet served by Play

Huge congratulations to Lithuanian Airports for their latest new route! Last week, Iceland’s low-cost PLAY Airlines launched direct flights between Reykjavik and Vilnius. This new route not only offers passengers a convenient non-stop option between these two vibrant cities but also provides seamless connections to the US and Canada 🌍✈️

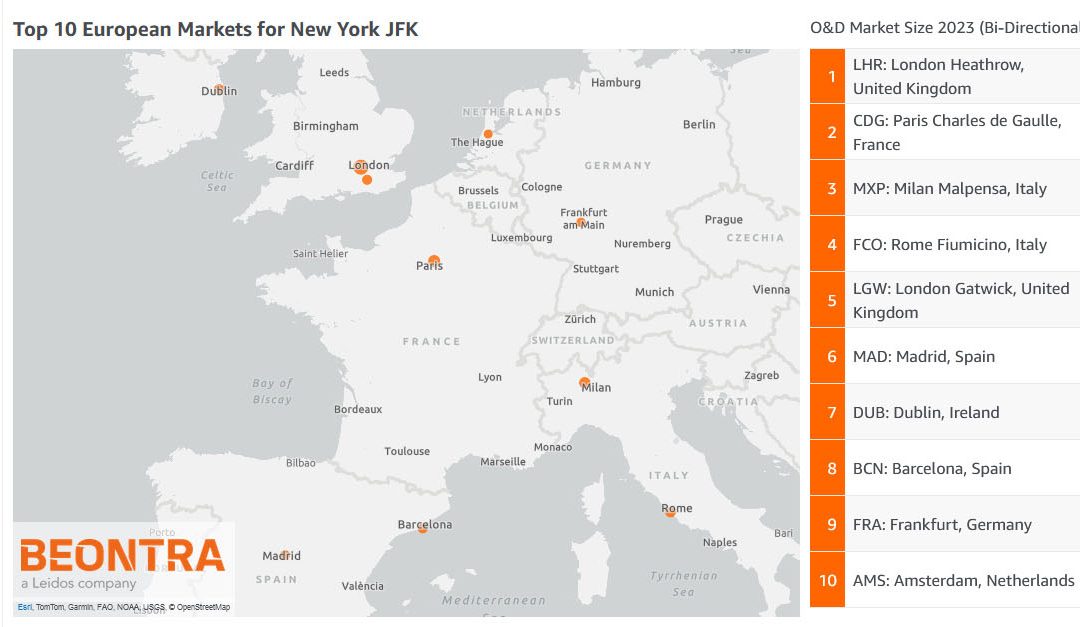

Using BEONTRA’s Route Forecasting solution, we delved into the data to identify potential new destinations for PLAY Airlines in Europe. Our analysis revealed the top 10 airports by O&D market size, with Manchester leading the pack, followed closely by Milan Malpensa and Oslo. 📊✨

We’re excited to watch PLAY Airlines grow and explore new horizons. To discover growth opportunities for your airport, visit www.beontra.com/solutions.

Stay tuned for more updates as we continue to support the aviation industry in uncovering new possibilities! 🚀✈️