Direction: Departure – Time Period: 01/2023 – 12/2023

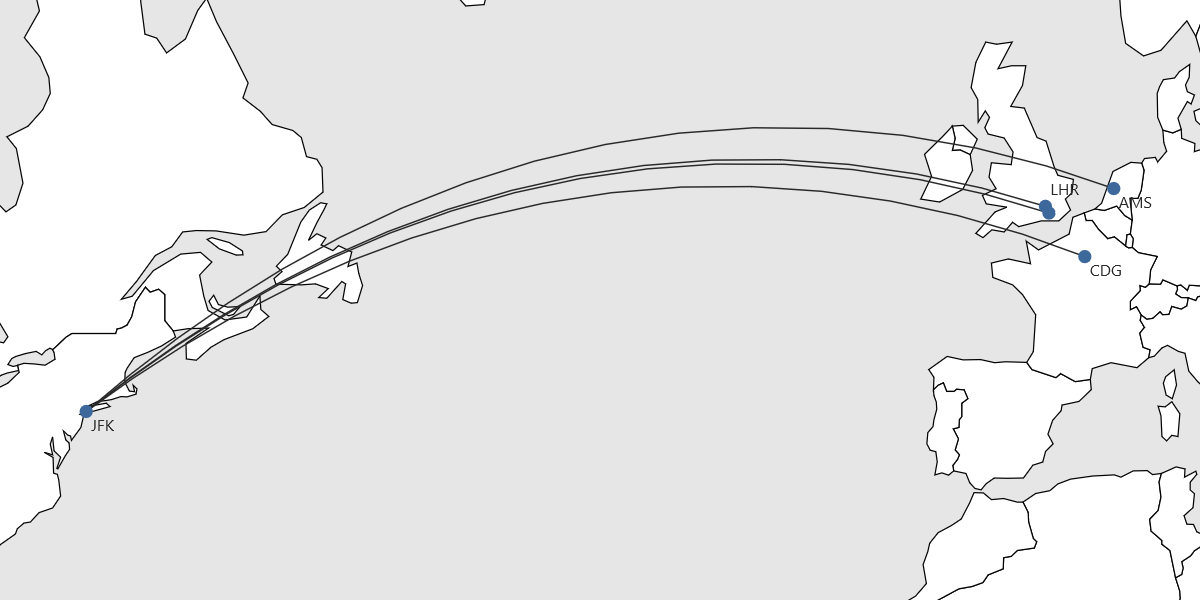

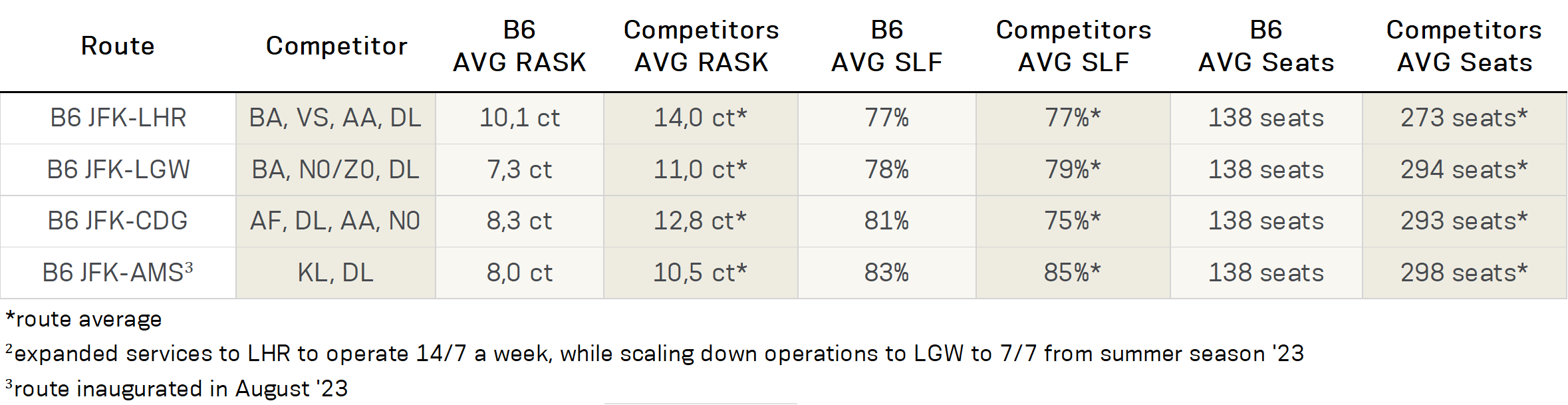

The substantial dedication of nearly half the plane to the Mint business class, however, underscores JetBlue’s heavy reliance on premium passengers. Despite effectively sustaining per-seat revenue amidst an impressive 140% surge in transatlantic capacity last year, the challenge lies in corporate travel still trailing up to 20% behind 2019 levels. This presents a significant obstacle for JetBlue and its targeted premium market, impacting their ability to achieve higher revenue per available seat kilometre.

Conclusion

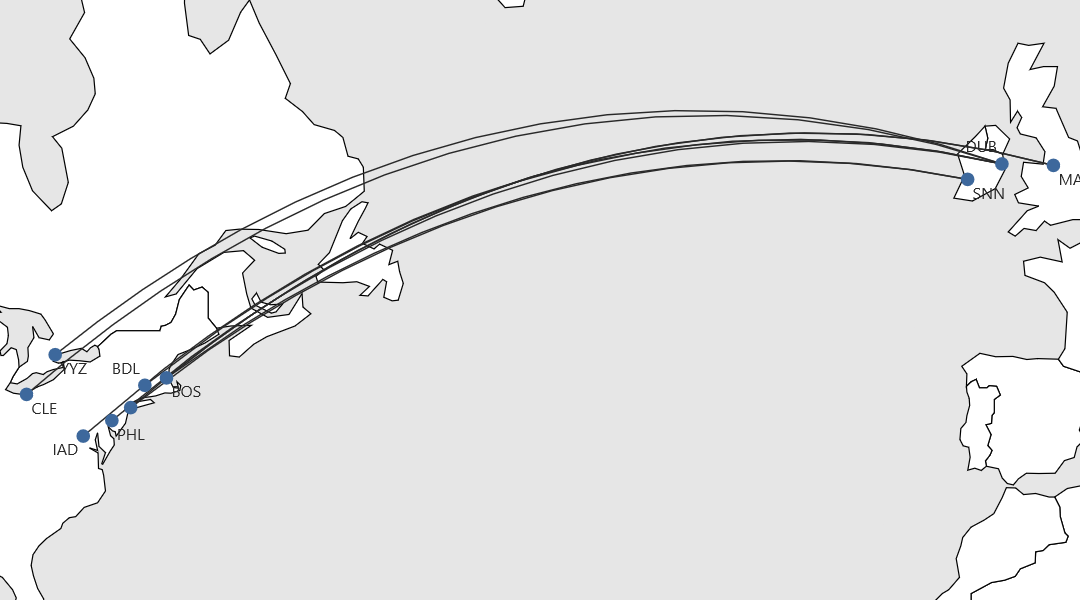

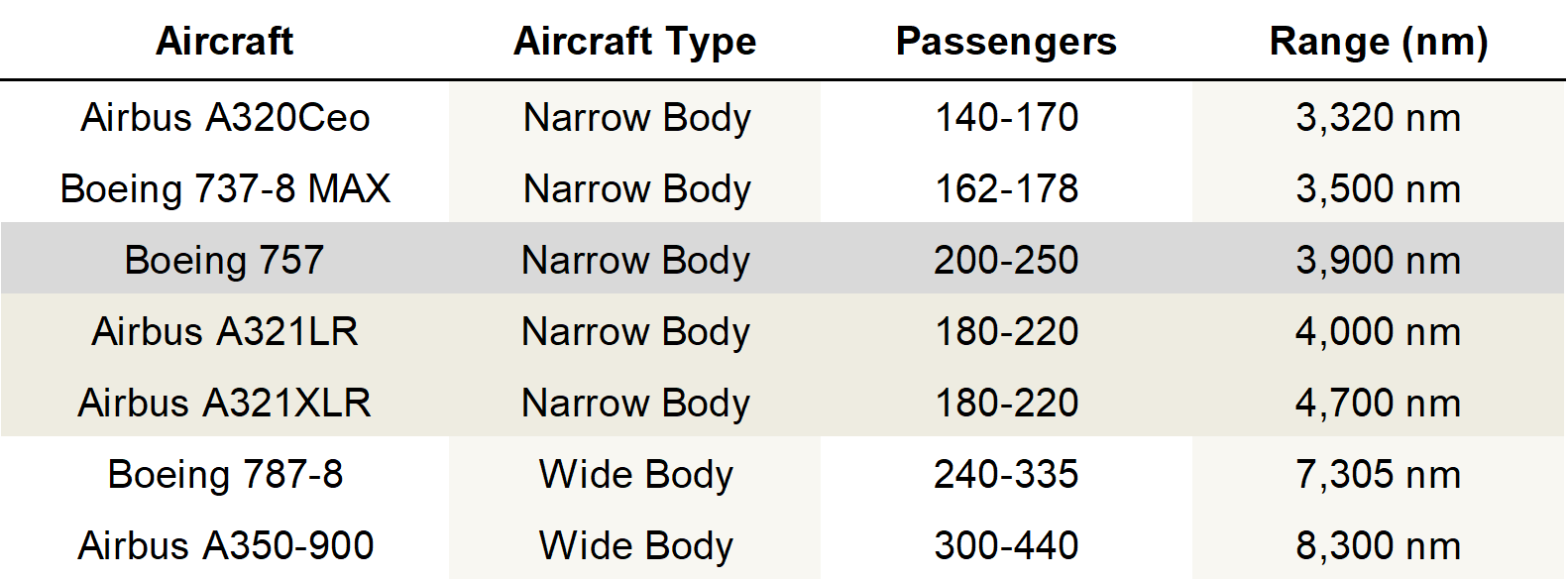

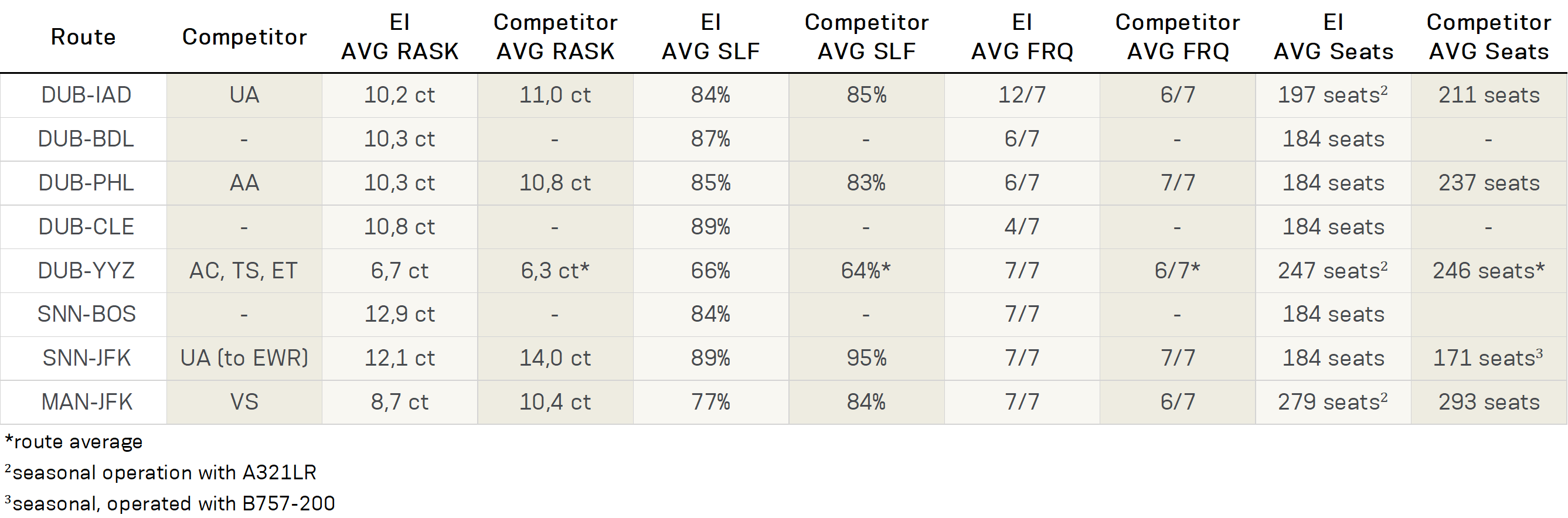

The examination of both Aer Lingus and JetBlue illuminates a discernible shift within the aviation sector towards embracing the A321LR as a replacement for ageing aircraft such as the B757 on transatlantic routes. Airlines are leveraging the fuel efficiency and extended range of this narrow-body aircraft to access new long-haul destinations while phasing out older models, notably the B757, from smaller routes in the mid-market segment. Furthermore, the analysis underscores the adaptability of airlines like Aer Lingus in tailoring capacity to meet demand on transatlantic routes, especially on seasonal routes where widebodies may not be economically viable year-round.

For LCC JetBlue, the A321LR heralds a prime opportunity to launch medium to long-haul routes, particularly across the Atlantic. Its reduced fuel consumption paves the way for potential fare cuts, empowering JetBlue to capture market share from entrenched rivals in the transatlantic arena through a distinct business approach. The enduring triumph of JetBlue’s business model, coupled with the promise of the forthcoming Airbus A321XLR—boasting thirteen units on order—continues to captivate industry observers. With more airlines embracing this cutting-edge aircraft, boasting an extended range of up to 4,700 nautical miles, it is poised to further transform the narrow-body mid- to long-haul market, including the transatlantic segment.