Research conducted by BEONTRA reveals that more than half of all newly introduced routes have an origin-destination (OD) market size below 1,000 passengers prior to the opening. This finding proves that the common approach to use OD demand data to identify potential new routes, is not effective for a large number of markets. Following discussions with analysts from leading airlines, BEONTRA has developed a method which takes the bigger picture into account. It will be available as a new feature in the B Route Development solution in March 2020.

Unserved short-haul markets often lack substantial existing traffic

OD market data are widely accepted by airports and airlines and play to their strengths in the analysis of established markets or large unserved markets. However, especially for short-haul destinations and emerging markets, the current market size on unserved routes is often too small to be a meaningful indicator for the viability of a non-stop service.

Many point-to-point airlines rely on route benchmarking

Due to the limited significance of OD data, airlines specialized in point-to-point services, such as low-cost carriers, often take their decisions based on a benchmark of routes. From their revenue management system, they know which of their existing routes are most profitable and they look out for potential markets with similar characteristics. Besides traffic data, the most frequently examined criteria are competition and catchment demography.

New BEONTRA feature ranks opportunities and proposes potential carriers

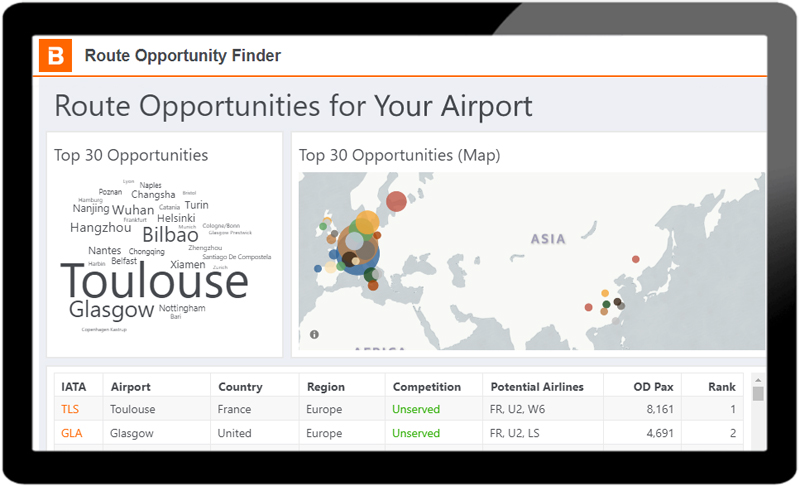

To enable airport route development teams to objectively judge market opportunities, BEONTRA is introducing a new feature to its route development solution. The “Route Opportunity Finder” automates route benchmarking and creates a ranking of potential new air services. The algorithm analyzes more than 50,000 actual airlines routes, which have been introduced in the past 10 years, and compares them against the characteristics of potential new destinations for your airport. Criteria used include traffic structure and competition as well as demographic data, such as catchment population and GDP.

The resulting ranking of promising routes reflects the airlines’ preferences derived from their market activity. Also, a recommendation of potential carriers, which could serve the route is provided. This amazing feature does not only save you time, but also eliminates your blind spot and makes you aware of markets which you might not have thought of.

About B Route Development

With this new feature, BEONTRA’s B Route Development product covers the full scope from the discovery of route opportunities to the creation and presentation of fully-fledged airline business cases. More than 30 airports world-wide put their trust in B Route Development, which is built on industry standard data sources, such as Sabre Global Demand Data, flight schedules and airline unit cost information. Find out more about B Route Development.

Interested? Contact us today for a free demo

LATEST NEWS

🌍 Unlock Your Airport’s Market Potential with BEONTRA Route Forecasting ✈️

We’re excited to introduce new features in our Route Forecasting solution, designed to help air service development teams analyze market potential and create compelling business cases for new air services.✨ What’s New?- Opportunities by Market Value: Go beyond OD...

Announcing the BEONTRA Community Tools 🚀

🚀 Exciting News from BEONTRA! 🚀 We are thrilled to announce the release of our BEONTRA Community Tools, starting with the Security Demand Forecasting tool – and it's completely free!Designed with small and medium-sized airports in mind, our new tool simplifies the...

28th BEONTRA Summit

✨ That’s a wrap on our 28th BEONTRA Summit! ✨On 19-20 September, we had the pleasure of hosting our incredible customers for an unforgettable event filled with engaging presentations, insightful workshops, and a touch of Italian hospitality.We exchanged valuable...