From the Midwest to the Middle East: Will Turkish Airlines connect key aviation markets with the new Detroit-Istanbul service?

The announcement of Turkish Airlines’ new flight between Istanbul (IST) and Detroit (DTW) starting November 15, 2023, encouraged us to have a closer look at the expected connectivity and impact for passengers traveling between the two cities and beyond. The flight will initially operate on Mondays, Wednesdays, and Fridays, with additional flights on Saturdays starting in late December 2023. The flight schedule is as follows:

IST-DTW: departure 15:45, arrival 18:50

DTW-IST: departure 21:35, arrival 15:35 (+1)

Turkish Airlines will use a Boeing 787-900 on that route, equipped with 30 seats in business class and 270 seats in economy class.

Since DTW is a hub for SkyTeam carrier Delta Air Lines, no significant behind traffic can be expected. The focus therefore seems to be on business-dominated point-to-point and transfer traffic in Istanbul, with VFR traffic likely to play a dominant role.

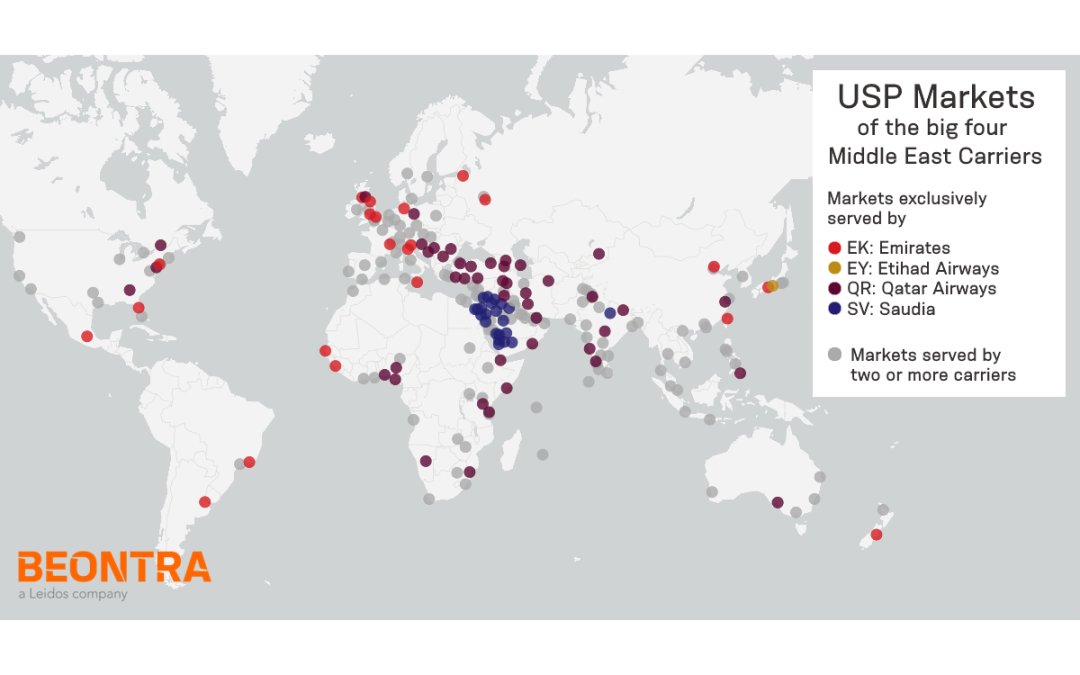

Even though Royal Jordanian already serves the target region with 4 weekly flights, connectivity will be significantly improved especially to the African and Indian subcontinent, in addition to the Middle East, due to the enhanced TK network.

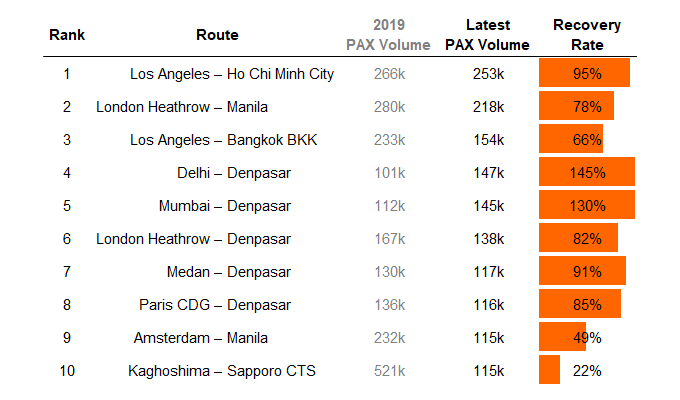

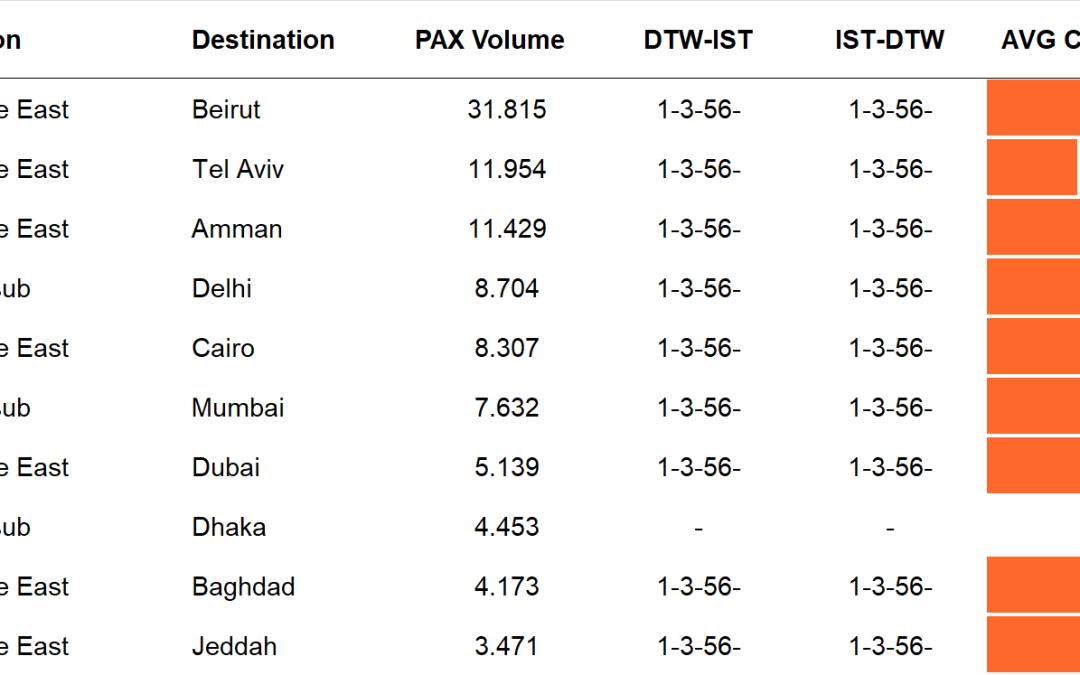

In the following, we would like to look at how successful Istanbul Airport is able to connect passengers originating from Detroit to the ten most important markets in the Middle East, Africa, and the Indian subcontinent, in terms of passenger volume. The table above shows the result.

Except for Dhaka with its arrival and departure time in the very early morning hours, all destinations can be reached both inbound and outbound, and on all flight days. However, Amman, Delhi, Mumbai, Baghdad, and Jeddah show quite long connecting times, so passengers would have to be somewhat patient connecting into those markets.

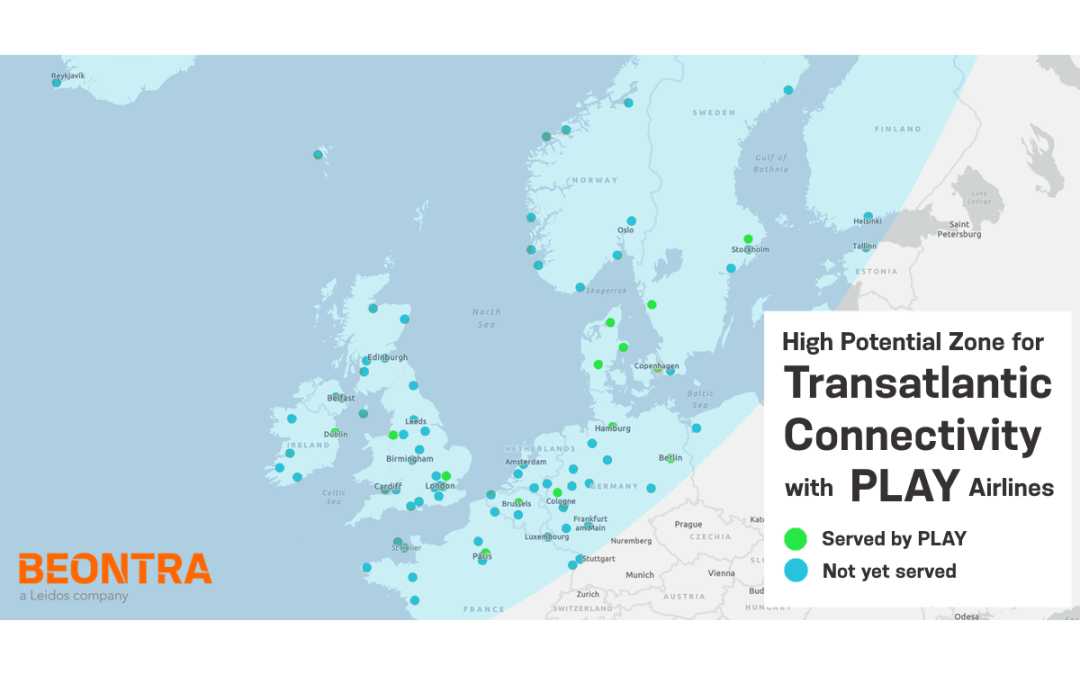

America’s car industry capital becomes Turkish Airline’s 13th destination in the US. Considering this, the integration of Detroit into the network of the airline, which continues to expand rapidly, is certainly a no-brainer. The simultaneous addition of Detroit and Denver – the latter a hub of Star Alliance partner United Airlines – to Turkish Airlines’ route network will significantly improve connectivity for travelers from the Midwest to the Middle East and the African and Indian subcontinent.