This article delves into the strategic utilisation of the A321LR by airlines in recent times, facilitating entry into new long-haul markets and addressing the need for replacing ageing aircraft, particularly the B757, in smaller existing markets. Launched in late 2018, the A321LR boasts an extended range of up to 4,000 nautical miles, achieved through the integration of three Additional Centre Tanks (ACTs). This inherent value has firmly established the A321LR as the unrivalled choice in the mid-market segment, with no contemporary alternative offering comparable advantages. To underscore this point, the article examines the transatlantic market, with a focus on Aer Lingus, which transitioned from the B757 to the A321LR, and JetBlue, a US Low-Cost Carrier embarking on long-haul flights with the A321LR. The analysis draws upon data from BEONTRA’s Route Forecasting solution, incorporating insights from Market Reports supported by Sabre Global Demand data.

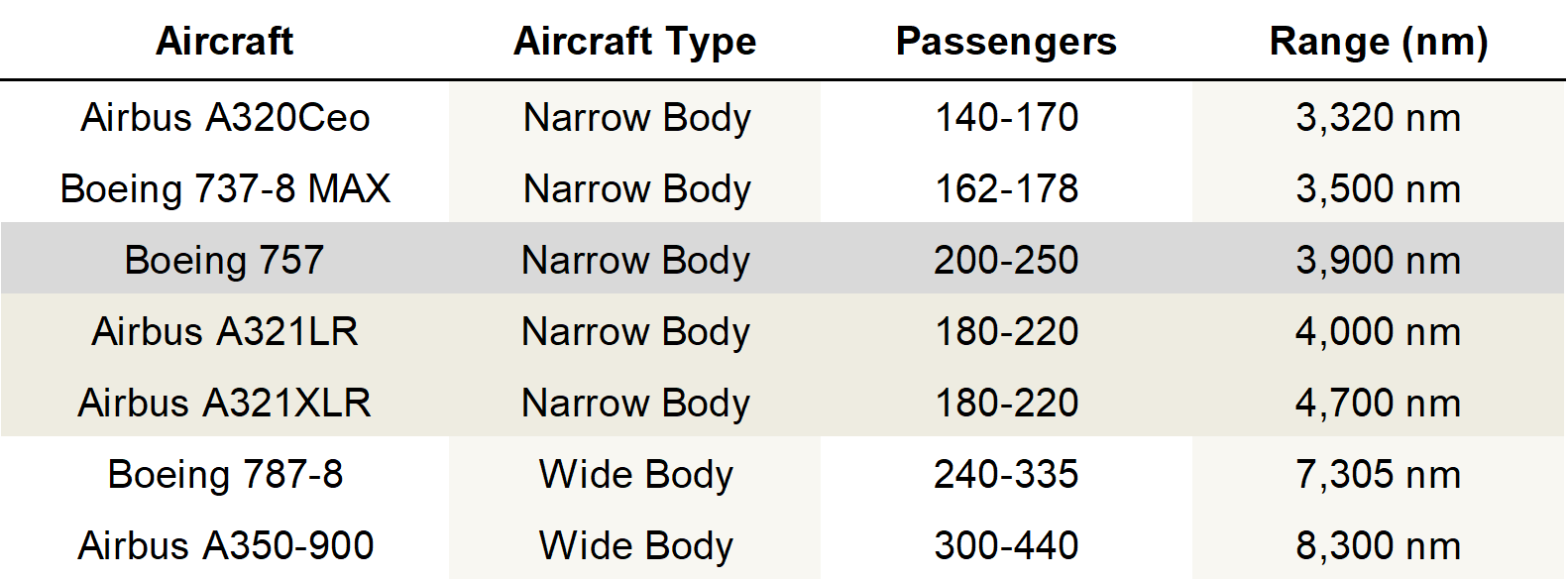

A321LR – Competitors and technical specifications

In the contemporary aviation landscape, the Airbus A321LR stands as a noteworthy contender for the B757’s role, boasting similar capacities and range. While both aircraft share comparable ranges, the A321LR outshines the B757 in terms of fuel efficiency, burning between 15% and 30% less fuel per seat compared to its older counterpart, as per Airbus data.

Selected aircraft technical specifications

Source: Airbus and Boeing

Efficiency in Transatlantic Travel: How Aer Lingus Perfectly Utilizes the Airbus A321LR

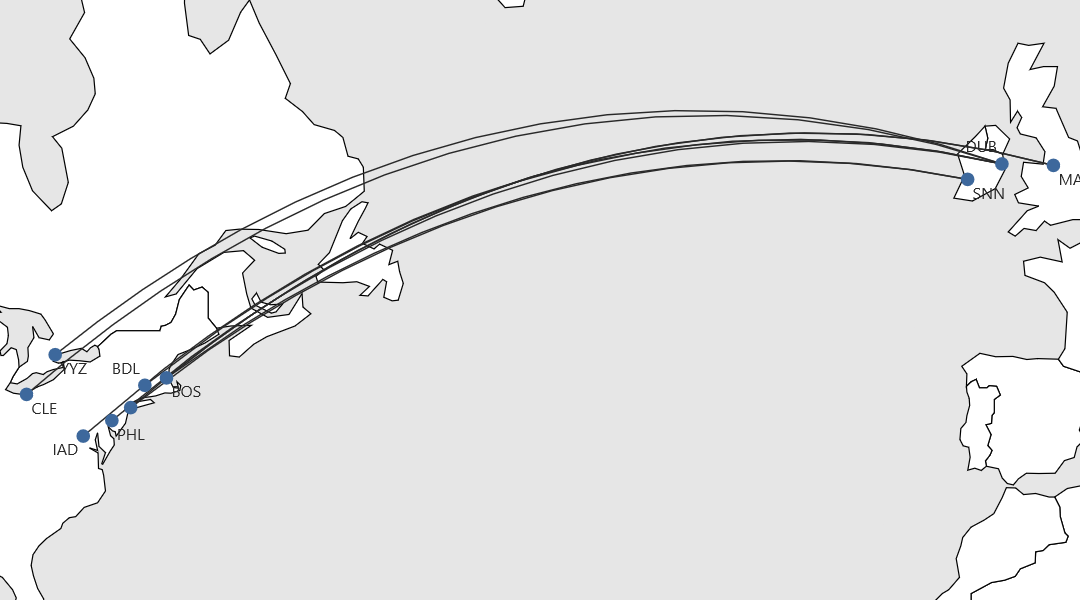

Aer Lingus, the Irish flag carrier, strategically operates its fleet of eight A321LRs, averaging around 3 years old, on transatlantic routes connecting Ireland and the UK to major North American cities like New York, Boston, Philadelphia, and Toronto (refer to the map below). These fuel-efficient aircraft, the most sustainable in the fleet, offer up to a 20% reduction in fuel consumption and a 50% reduction in noise. They operate from Dublin, Shannon, and Manchester, complementing the airline’s network alongside A320 family narrowbodies and A330 widebodies. The A321LR’s efficiency proved crucial during the pandemic, providing a cost-effective solution. In contrast, Aer Lingus heavily relied on the Boeing 757 in the mid to late 2010s, particularly on transatlantic routes like Shannon to Boston, where the now-deployed A321LR enhances efficiency and further expands into the North American market.

Aer Lingus: Comprehensive Map of Transatlantic Routes Served by A321L

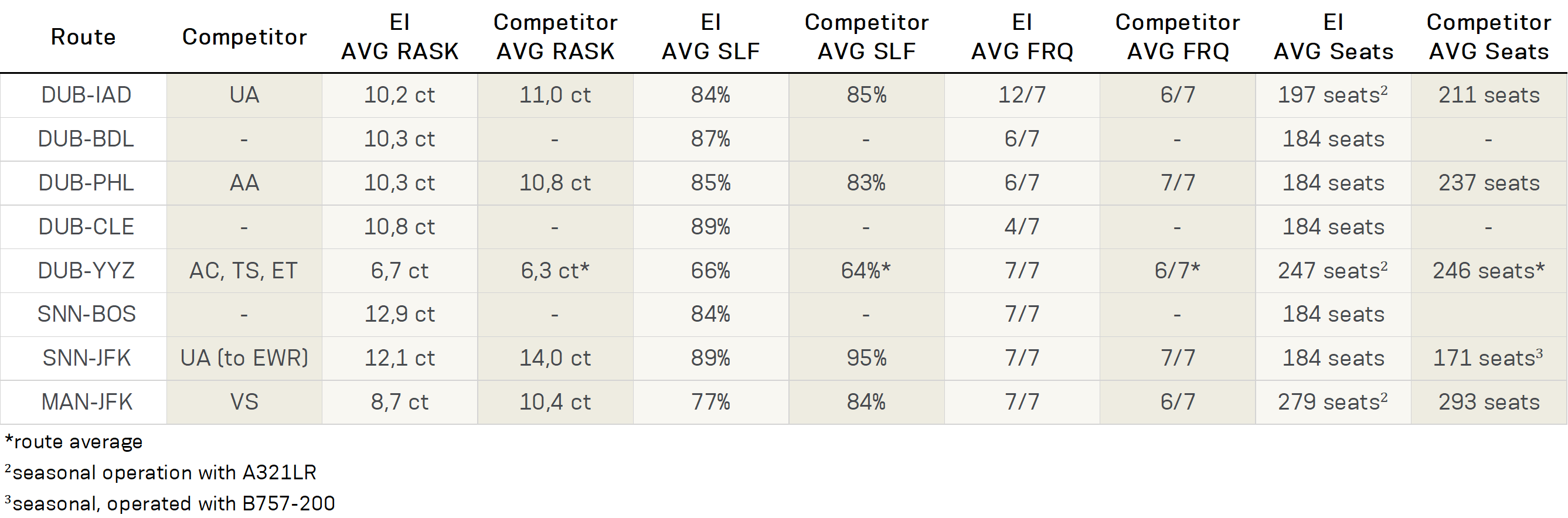

In the table below, we evaluate Aer Lingus’ A321LR route performance in 2023, analysing key indicators and comparing them with direct competitors in respective markets. The assessment reveals Aer Lingus’s competitiveness, particularly in achieved average load factors and RASK, showcasing their strength against rivals in competitive segments. The consistently high load factors achieved signify effective deployment of appropriately sized aircraft for selected smaller transatlantic routes. Additionally, Aer Lingus strategically utilizes widebodies, such as during last summer to Washington (IAD) and Toronto (YYZ) from Dublin, or to New York (JFK) from Manchester, depending on demand. Notably, competitors like United Airlines still operate 757-200s on smaller secondary routes, indicating Aer Lingus’ adeptness in optimizing its A321LR variant with up to 27% lower trip costs, 24% lower per seat costs.

Aer Lingus Route Performance – Selected Routes operated by A321LR

Direction: Departure – Time Period: 01/2023 – 12/2023

JetBlue’s Transatlantic Triumph: Soaring Across the Pond with the A321LR

JetBlue’s A321LR transatlantic venture, launched from New York-JFK to London Heathrow and Gatwick in August 2021, has exceeded expectations with high demand and remarkable load factors. The aircraft’s efficiency has become a cornerstone of JetBlue’s fleet, facilitating expansion into new markets and meeting evolving passenger preferences. Building on this initial success, JetBlue expanded its transatlantic reach to Paris and Amsterdam last year. Currently operating nine A321LRs, JetBlue envisions four additional aircraft supporting its growing European operations in 2024, potentially opening doors to more markets. Notably, Boston is scheduled to receive a year-round Paris service with the A321LR launching on April 3, 2024, and JFK will introduce a second CDG flight on June 20, 2024.

JetBlue: Comprehensive Map of Transatlantic Routes Served by A321LR

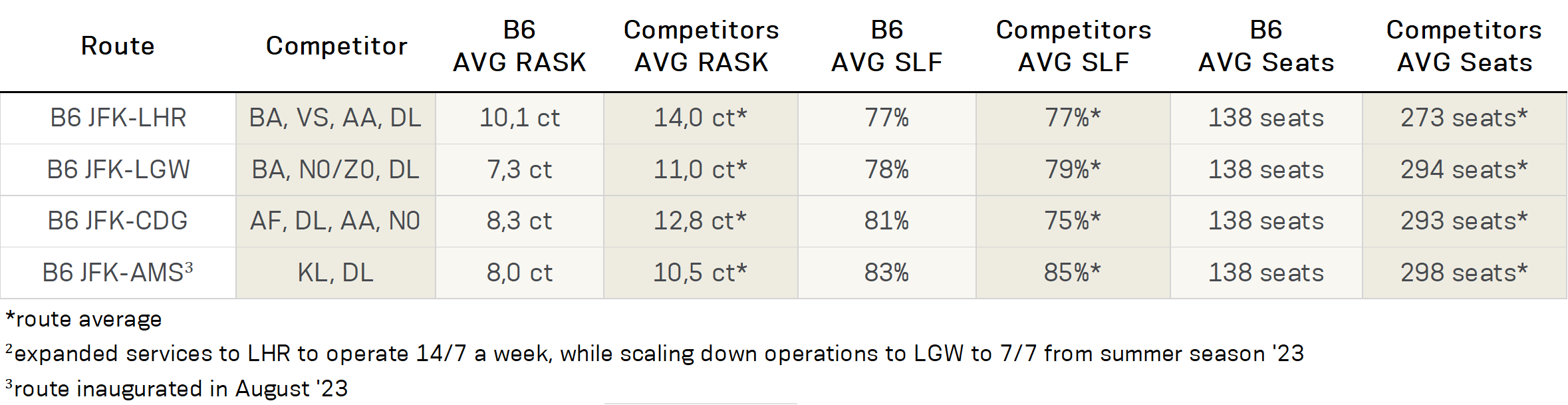

Examining the table below, which assesses how well the A321LR performs on transatlantic flights by JetBlue, it becomes apparent that the US Low-Cost carrier holds a robust competitive position in the respective markets against well-established rivals. The attained average load factors highlight JetBlue’s effectiveness, especially in capitalizing on its extensive network that feeds into its hub in New York JFK. While JetBlue efficiently operates a modern, fuel-efficient narrow-body aircraft with a competitive cost structure, there is still room for improvement in the average RASK achieved on A321LR’s transatlantic routes. This is noteworthy despite the airline’s ability to provide lower fares, in large parts thanks to its deployment of the fuel-efficient A321LR.

JetBlue Route Performance – Selected Routes operated by A321LR

Direction: Departure – Time Period: 01/2023 – 12/2023

The substantial dedication of nearly half the plane to the Mint business class, however, underscores JetBlue’s heavy reliance on premium passengers. Despite effectively sustaining per-seat revenue amidst an impressive 140% surge in transatlantic capacity last year, the challenge lies in corporate travel still trailing up to 20% behind 2019 levels. This presents a significant obstacle for JetBlue and its targeted premium market, impacting their ability to achieve higher revenue per available seat kilometre.

Conclusion

The examination of both Aer Lingus and JetBlue illuminates a discernible shift within the aviation sector towards embracing the A321LR as a replacement for ageing aircraft such as the B757 on transatlantic routes. Airlines are leveraging the fuel efficiency and extended range of this narrow-body aircraft to access new long-haul destinations while phasing out older models, notably the B757, from smaller routes in the mid-market segment. Furthermore, the analysis underscores the adaptability of airlines like Aer Lingus in tailoring capacity to meet demand on transatlantic routes, especially on seasonal routes where widebodies may not be economically viable year-round.

For LCC JetBlue, the A321LR heralds a prime opportunity to launch medium to long-haul routes, particularly across the Atlantic. Its reduced fuel consumption paves the way for potential fare cuts, empowering JetBlue to capture market share from entrenched rivals in the transatlantic arena through a distinct business approach. The enduring triumph of JetBlue’s business model, coupled with the promise of the forthcoming Airbus A321XLR—boasting thirteen units on order—continues to captivate industry observers. With more airlines embracing this cutting-edge aircraft, boasting an extended range of up to 4,700 nautical miles, it is poised to further transform the narrow-body mid- to long-haul market, including the transatlantic segment.